How Do Spread Betting Companies Make Money

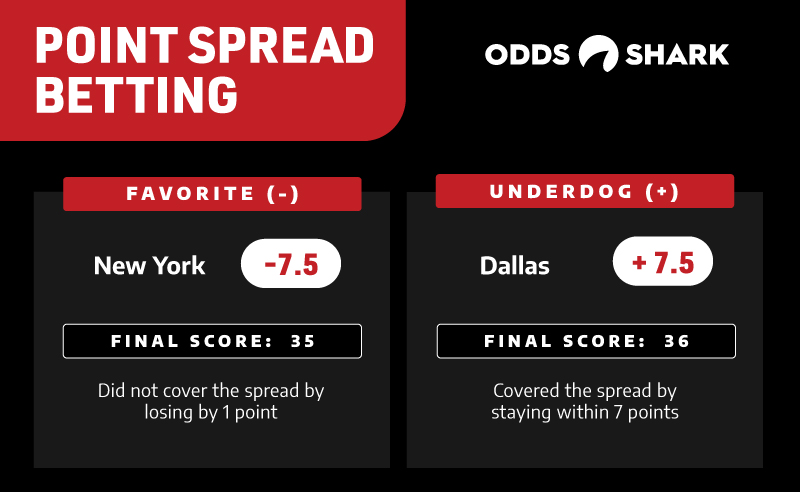

Spread Betting Companies What is Spread Betting? A spread which is a range of outcomes between bid and offer price, and the bet which is guessing whether the outcome will be above or below the spread offered by the particular broker makes together an attractive option Spread betting.

What is Spread Betting?

- Spread betting providers earn their money on spreads. You should also be aware that if you let your trades run overnight to the following day then you will also be charged a small financing fee which is based on LIBOR, plus any extra commission that the spread betting provider.

- Spread betting companies grew from traders betting on currencies and financials in the City of London. The bookmaker issues a spread and the bettor or trader bets on the outcome being higher or lower.

A spread which is a range of outcomes between bid and offer price, and the bet which is guessing whether the outcome will be above or below the spread offered by the particular broker makes together an attractive option Spread betting.

It means you speculate on financial markets in the same way as trading derivatives but with no single stake to limit loss. Eventually, you trade without taking any position in the current security, but to create an active market for both sides, respectively the ones who selling and the counterparty is buying. Discover more about Spread Betting Wikipedia.

CFD vs Spread Betting

While CFDs are short-term derivative contracts for the difference you will speculate on the value of the underlying asset. So the concept of trading between CFDs and Spread Betting is different since Spread Betting is just a bet on the direction of price movement. Yet, both share the same point that you just speculate on the movement itself without actually owning the asset itself, also through the use of leverage.

- Spread Betting Companies usually offer to bet across multiple asset classes and including forex, even with Cryptocurrencies, commodities, indices, and shares.

Registration

Spread Betting shows significant growth within the UK for the last years and is regulated speculative trading activity by the local authority FCA. Read more about Why trade with FCA brokers and see its official FCA website to verify licenses. Yet, spread betting concentrated mainly in the UK due to its legal authorization and even a tax break on profits, while many world countries forbid spread betting for various reasons.

- Spread betting should be strongly reviewed and controlled, as a leveraged investment brings both opportunities to significant gains or losses.

Thus, the broker provider should be carefully selected after consideration of all applicable local laws and regulatory statutes. In case the company or broker offers you unauthorized Spread betting possibility, you should not be allured with an attractive opportunity. As in fact, only regulated and authorized trading adheres to safe trading practices and may be classified as a potentially safe investment. Otherwise, you may easily fall under the fraud.

Best Financial Spread Betting Platforms and Brokers in UK

Due to its popularity in the UK, many UK based Brokerages offer Spread Betting option, yet from the company to another platform may feature some differences. That’s why we recommend reading the FCA Handbook to learn more about Spread Betting and choose only reputable firm.

Below you will find a listing of the Best Reviewed Brokers offering Spread Betting also with some narrowed criteria ranked.

- Pepperstone– Best Overall Spread Betting Broker 2020

- City Index– Lowest Spread Spread Betting Broker 2020

- FXTM – Best MT4 Spread Betting Broker 2020

- XM – Best for Beginners Spread Betting Broker 2020

- FXCM– Best for Scalping and EA Trading Spread Betting Broker 2020

The complete List of Financial Spread Betting Brokers in UK

This is the complete list of regulated brokers that offer a Spread Betting platform available for UK clients.

| Broker | Detail | |

|---|---|---|

| FXTM | Max. Leverage: 1:30 1:200 Regulation: CySEC,FCA, FSCA | FXTM Review |

| FP Markets | Min. Deposit: 100 US$ Trading Platforms: IRESS, MT4, MT5 | FP Markets Review |

| Pepperstone | Min. Deposit: 200 US$ Trading Platforms: MT4, MT5, cTrader Regulation: ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN | Pepperstone Review |

| BDSwiss | Min. Deposit: 100 US$ Trading Platforms: MT4, MT5, BDSwiss Webtrader | BDSwiss Review |

| HotForex | Min. Deposit: 5 US$ Trading Platforms: MT4, MT5 | HotForex Review |

| XM | Min. Deposit: US$5 Trading Platforms: MT4, MT5, XM WebTrader | XM Review |

| FXCM | Min. Deposit: 50 US$ 300 GBP Trading Platforms: MT4, Trading Station, ZuluTrade, TradingView, Ninja Trader | FXCM Review |

| City Index | Min. Deposit: 100 GBP Trading Platforms: Advantage Web, AT Pro, MT4 | City Index Review |

| Finspreads | Min. Deposit: 50 US$ Trading Platforms: Advantage Web | Finspreads Review |

| Nadex | Min. Deposit: 250 US$ Trading Platforms: Nadex Platfrom, NadexGO | Nadex Review |

- 1

- …

But how do providers make money? Do they hedge or are they betting against clients?

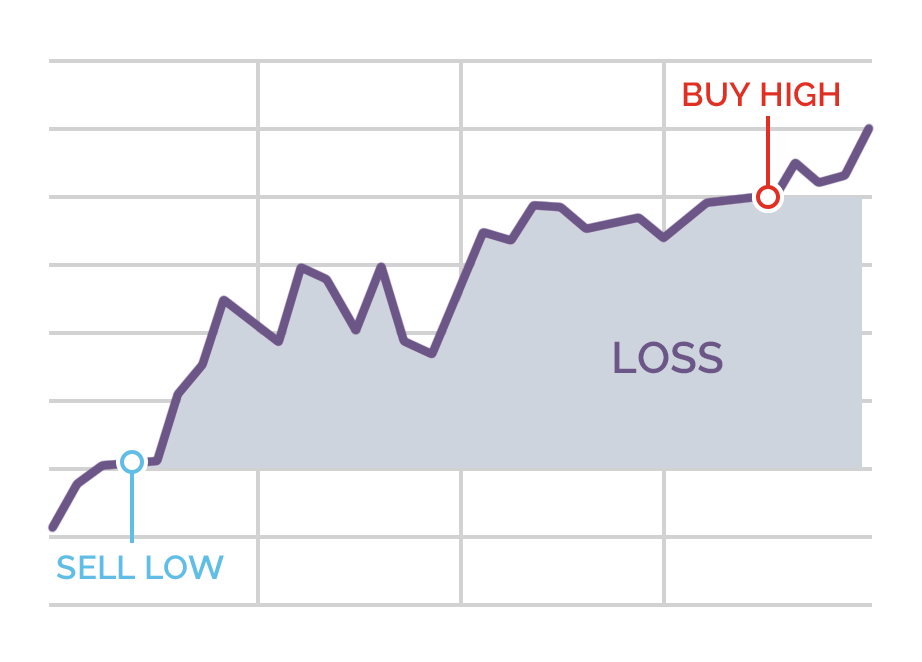

Just wondering: if you’re always paying out to winners, how do you make the money then? Say the spread is 2 pips and someone is always making 50 pips, aren’t you making a loss of 48 pips? Where does the money come from in this model to ‘pay out’ the winners? Given that from my understanding, the ‘balancing’ exercise only occurs when a spread betting position is closed? Presumably for it to work there must be a balance of people betting in the opposite direction?

It is a misconception that spread betting companies rely on losers to provide the company’s profits. Spread betting providers aren’t daft, and the bigger ones are likely to hedge their bets using the underlying assets – if most traders are placing bets on a BP recovery, the bookie will buy the underlying stock to lay off the risk.

“In some dark corners of the internet, you can find claims that IG Index bets against its own clients. That’s not really the spread betting provider is doing at all. The company doesn’t care if the client wins (or, in truth, if he loses, as long as he keeps playing/trading); it does care about being able to hedge the downside risk though.”

Of course spread betting provider do run residual positions. Most allow traders to bet in GBP while providers have to hedge in USD or JPY or whatever. Some spread betting companies even permit people to trade in 10 pence, and obviously it is not possible to hedge a 10p a point of Vodafone…

Here’s what an experienced had to say -:

Spreadbetters are Bookmakers…full stop

My father and Grandfather were bookmakers in the 60’s and 70’s

They made a “book” on every race they covered…the name of the game was to ensure they made a small % return on every race by overounding the odds (if they could) and/or by laying off larger bets into the larger money men in the business to ensure they never got stung on a big (losing) bet.

To cut a long story short the greedy ones took risks and did not lay off…taking the risks themselves covering the big bets…if it went wrong they disappeared (under concrete) or ran away…if it went right they made a lot of money…lots of money.

Spreadbet firms pretty much do the same but make even more money than this…they can lay off the big bets to the wider market and still take a nice margin on the spread offered …and also if they chose they can simply take the opposite side of a trade and just plain gamble against the trader where winner takes all… no lay offs…all profit if it works in their favour.

The kicker here is that their isn’t no horse charging over the line to decide the absolute win/lose outcome…the Spreadbetter can “control” the price of the market and thereby mitigate any potential losing bets they are taking hits on…and maximise the win…

That’s life…

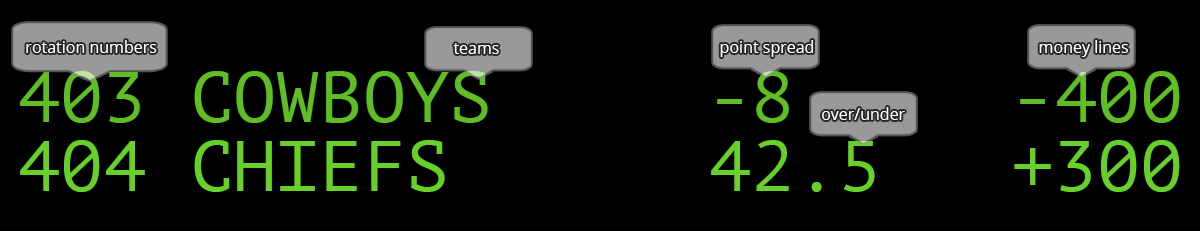

Depending on the degree of hedging that is put in place which may vary from company to company, what they want is activity to make money off the bid/offer spread. You need to understand here that spread betting is not exactly trading (and spread betters are bookmakers not brokers) and you’re not participating in the market. It’s all in-house environments. They stream prices (which are easily manipulated) to you which follow the real market and let you bet on the outcome. The spread is their commission, that’s how they make money.

The key for providers is to have a large enough book to hedge internally without having to pay the market – there are actually other methods of reducing risk but if hedging is real, they’re definitely doing in internally.

One client goes long FTSE, another will go short. You are netted off and capturing risk free spread. Do that over 50k clients every second of a 24 hour day and it soon adds up. You still run exposure but it is ‘total’ and not specific to individual clients. Large trades, above your tolerance you simply hedge regardless and take the commission.

The perfect situation for a spread betting company is when the opposite sides (buy and sell) match – then they pick up the spreads and live happily after. So hedging would be to sum up the total value of buys and sells for an instrument (say EURUSD) and if the ratio is 60k:40k they would add the 20k to match the positions and pick up the spread. It’s kind of how market makers (or bucket shops if you will) make money in spot fx market.

If you specifically bet against the client you have to have a lot of staff who are paid to simply monitor what the clients are doing and adjust spread, fill timings etc to ensure the bulk of trading is in your favour. Either that, or you have to run enormous exposure on your book and rely on the stat that most clients lose. However, when the collective wins, as happened last year, you are crucified.

With spreadbets, spread betting brokers quote their own bid/ask prices that are -:

- Based on the underlying market but wider.

- Change spread with market volatility

- They are in effect the market maker on every trade.

So when a spread betting provider gets a client that is trading in big size or is a consistent winner they hedge (or as a bookie calls it lays off the bet). This can causes some people problems because the trade is no longer instant and will cause a short term trader / scalper to lose their advantage. If the trader is a longer term trader then it is not a problem, the spread betting company can hedge the bet and make money on the commission and the trader will win or lose depending on their system. If you are a profitable scalper then you cannot use a spread betting company, you must move to a broker account and then your system has to generate sufficient profit to exceed the trading costs. You can’t have your cake and eat it, if you expect a spread betting company to continually lose money to you then how do you expect them to stay in business. Einsteins definition of insanity is doing the same thing repeatedly and expecting a different result.

In any case for the vast majority of clients, as long as a provider’s price accurately tracks the underlying and you can trade with limited slippage, there is little to worry about – particularly if the firm itself is financially healthy. We just need good prices based on the underlying market, consistent execution, with no delays and rejections caused by spread trading companies ‘reading ahead’…

Proof that spread betting providers hedge from a person posting on a bulletin board:

“Right just picked up this response from the Managing Director of Spreadex posted on the iii board and it backs up exactly my Findings that Spreadex have brought and paid for the entire 17.65% Holding in Canisp and it was never a spreadbet as they do not do CFDs for companies with a market capitalisation below 7mln!!”

“This is the reply that I received from Spreadex today. It is a 100% genuine investment and as you can see if Canisp fold, they are set to lose, if my maths is correct, over £600,000. This has cemented my views on this stock and I will be holding awaiting news.”

QUOTE:

Financial Spread Betting Companies

“Many thanks for your note. You are clearly an observant holder of the stock!! As you are aware Spreadex offers financial spread bets and CFDs to its clients. It is not part of our business model ‘to bet against our clients’ and therefore we hedge most of our risk. Such hedging is achieved by buying the underlying stock either as fully paid up stock or a CFD. In the case of Canisp – we have purchased our holding as fully paid up – hence our entry on the share register.”

“We are therefore cheering on the share price on behalf of our client.”

“I hope I have answered your question – but please do not hesitate to contact me if I can provide any further information.”

Betting Company Spread

Kind Regards

Jonathan Hufford

Managing Director

www.spreadex.com

But it is NOT Spreadex ‘buying’ the stock, he states quite clearly that they ” do NOT bet against their clients”, so a client took a position and Spreadex went and bought in the market to cover the wager. Clearly Spreadex were happy to make an exception in this case regards market cap.

Simon Denham, CEO at Capital Spreads had this to say: ‘Whilst customers are clearly quite important to spread trading firms traders should try to avoid thinking too personally about their trades. For most clients we are totally unaware of their individual deals as the trades simply go into one huge pot which we refer to as the “risk book”‘. Normally, we only concern ourselves with the net position on the “risk books” and as such clients making ten/twenty pound trade/order in any market simply won’t register. Almost all our clients are on auto-execution which can be even better than direct market access trading as it means that you will almost always be filled on trade whereas on DMA you must rely on their being sufficient liquidity to your trade request. Winners/Losers ratios on spread trades are almost exactly the same as private clients using Futures/Forex Trading/Margined Equity ‘

An interesting point is that a spread trading company will actually want you to make money or breakeven to continue trading. Why? Because losers may end up being bad for business. Nobody will recommend it to others if they have just lost a packet. If you win, even win a lot, a good spread betting company won’t mind because they don’t carry that risk themselves. They balance the buy bets with the sell bets and if there is a significant difference, they lay that risk off on the market. All they are interested in is making the spread on every trade.

However, I’ve heard that spread betting providers might not particularly like consistent small winners who bet with small stakes, i.e a spread betting provider is unable to hedge against tiny 50p/£1/£2 pp stakes. I’m not sure if this is actually so much of a problem because providers could always aggregate shorts and longs (in any given instrument) – and it doesn’t really matter to them whether this pot is made up by a handful of big betters or an army of tiny punters. I think the only thing that might bother them is if there is a huge discrepancy between longs and shorts: then they would have to protect themselves. Having said all that, at the end of the day it’s down to spread betting company to manage the risk, and it’s down to them to decide if they want to hedge or take the risk. All, I know for certain is that if you trade successfully all of the brokers will go out and hedge your positions (if they cannot balance the books internally and your stake is significant). They cannot always hedge pound for pound so they run part of business as a bookie and part as broker, mainly broker these days.

The idea is they make money on the spread but within a broader context of all positions per instrument, eg, all FTSE positions would be hedged as much as possible in underlying etc and yes like a bookie they must balance the unhedged part of business but put it this way, if you traded anything that has genuine exchange data (i.e. anything except FX) then the spread bet price would be exactly as exchange with a spread around it and much more transparent for us clients.

“Spread betting providers make their money primarily through the dealing spreads but also from currency conversions, financial charges and other factors”

Good spread betting firms make profit because they understand and manage risk. The exact opposite of most of their clients. Spread betting providers earn their money on spreads. You should also be aware that if you let your trades run overnight to the following day then you will also be charged a small financing fee which is based on LIBOR, plus any extra commission that the spread betting provider wishes to add. Assuming the spread betting provider will do its best to stay risk neutral, they will want you to trade as much as possible and thus earn the spread over and over. This is because you can milk a client who is making money for a lot more on the hidden extras like spread, funding, data fees, loss of interest on capital, currency transfers. ..etc.